Why You Shouldn’t Take Your House Off the Market During the Holidays

If you are one of the many homeowners who is debating taking your home off the market for the next few weeks, don’t! You will miss the great opportunity you have right now!

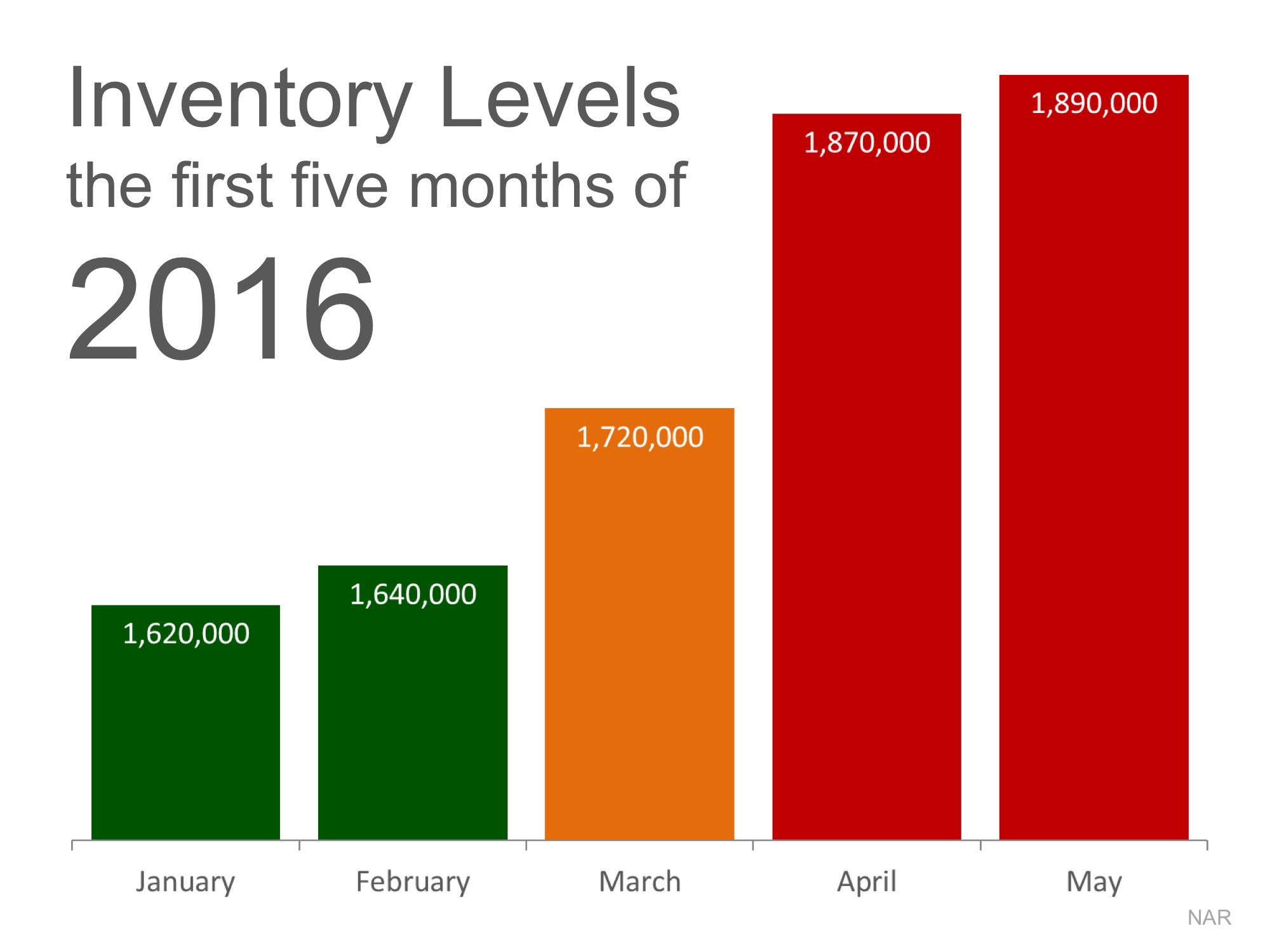

The latest Existing Home Sales Report from The National Association of Realtors (NAR), revealed that the inventory of homes for sale has dropped to a 4.3-month supply.

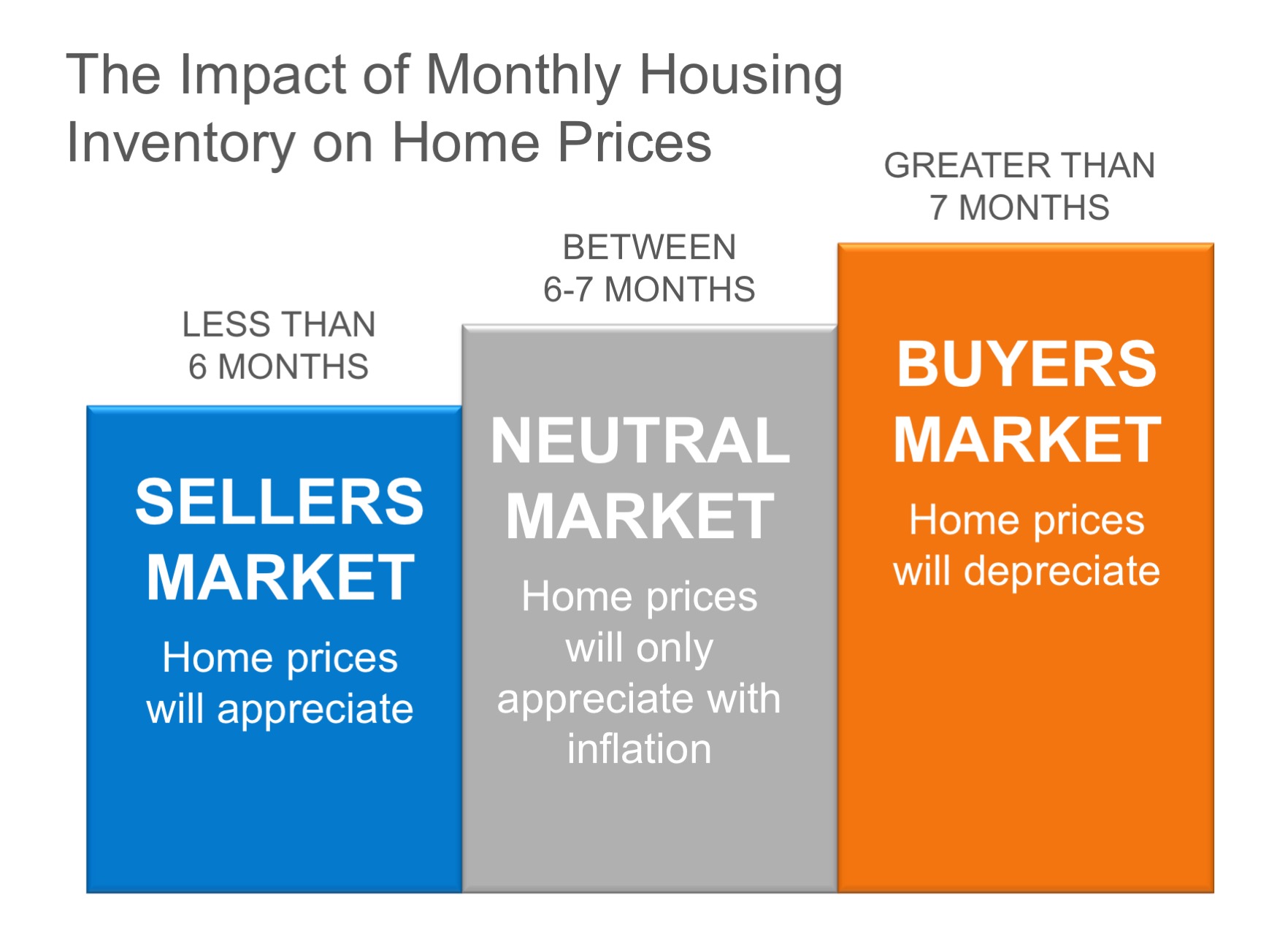

Historically, a 6-month supply is necessary for a ‘normal’ market, explained below:

There are more buyers that are ready, willing, and able to buy now than there have been in years! The supply of homes for sale is not keeping up with the demand of these buyers.

Bottom Line

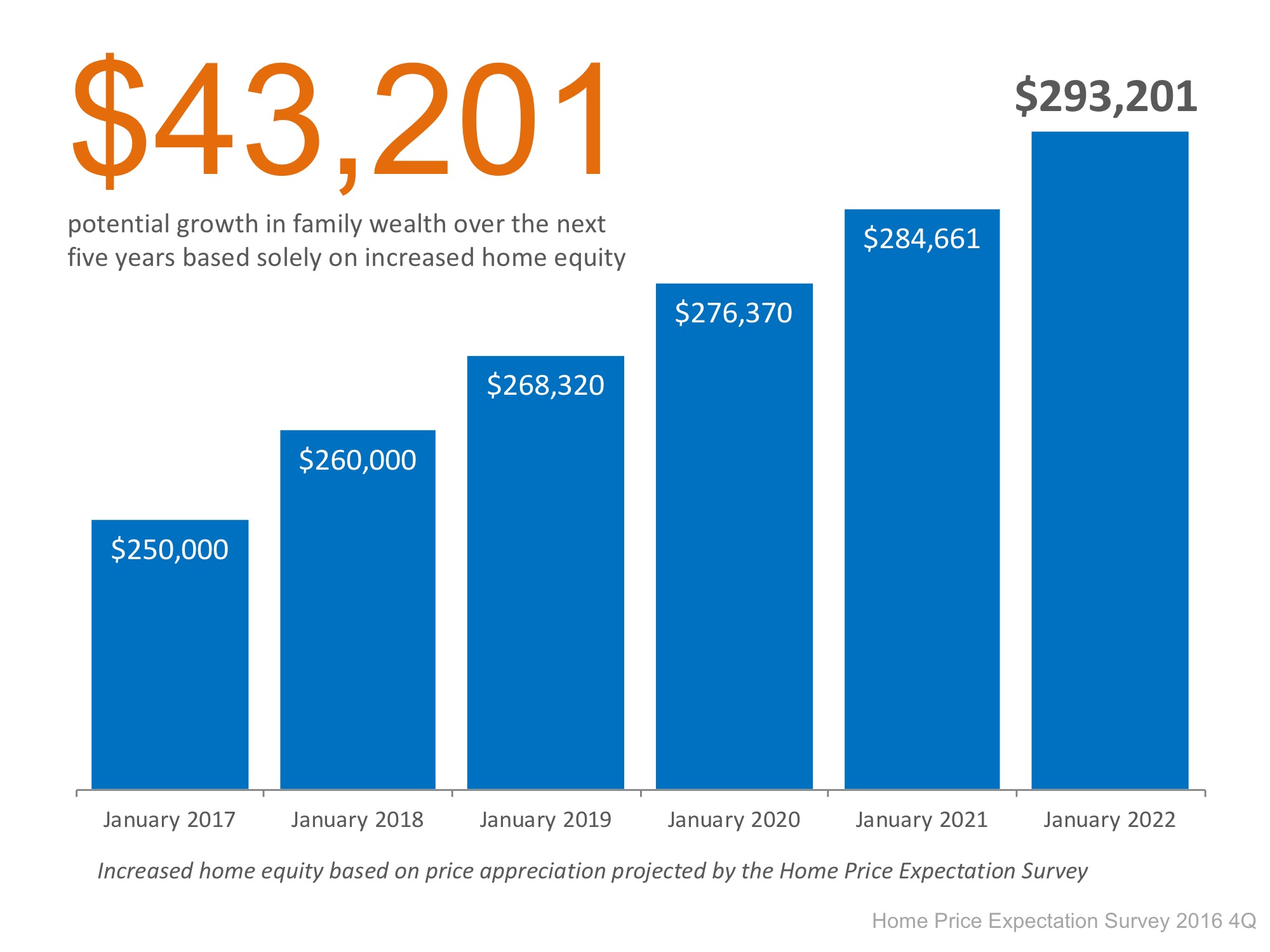

Home prices are appreciating in this seller’s market. Making your home available over the next few weeks will give you the most exposure to buyers who will be competing against each other to buy it.

![Americans Are on The Move [INFOGRAPHIC] | MyKCM](https://d8yi0qr1xsq5x.cloudfront.net/2016/12/08101344/MovingAcrossAmerica2016-STM-1046x1354.jpg)